how to avoid sales tax on a rolex | does Rolex pay taxes how to avoid sales tax on a rolex If you owed the sales tax, it's not legal to avoid paying it. It may be no one charged you sales tax, but that does not mean you don't owe it. ‘Tanked’ star Brett Raymer closes Las Vegas donut business Donut Mania will not be open for business on Monday, and its future seems uncertain. The chain abruptly ceased operations at all.

0 · should i buy a Rolex

1 · sales tax on Rolex watches

2 · does Rolex pay taxes

3 · do Rolex watches sell tax free

4 · Rolex sales tax laws

5 · Rolex sales tax exemption

6 · Rolex sales tax avoidance

7 · Rolex no sales tax

The BBC Domesday Project was a partnership between Acorn Computers Ltd, Philips, Logica and the BBC. It marked the 900th anniversary of the original Domesday Book, an 11th century census of England. It was compiled .

should i buy a Rolex

With this in mind, one of the most common questions potential buyers ask is: where can you buy a Rolex in the USA and legally avoid the payment of sales tax? The best way to achieve this is to purchase a Rolex .

You should carefully check the tax laws concerning “use tax” if your state . With this in mind, one of the most common questions potential buyers ask is: where can you buy a Rolex in the USA and legally avoid the payment of sales tax? The best way to achieve this is to purchase a Rolex online, although it is important to understand precisely how this works and what the limitations are. You should carefully check the tax laws concerning “use tax” if your state imposes a sales tax. If you purchase an item in a state with lower (or no) sales tax, you owe the amount of tax difference.

dior ambassador sehun

sales tax on Rolex watches

If you owed the sales tax, it's not legal to avoid paying it. It may be no one charged you sales tax, but that does not mean you don't owe it.

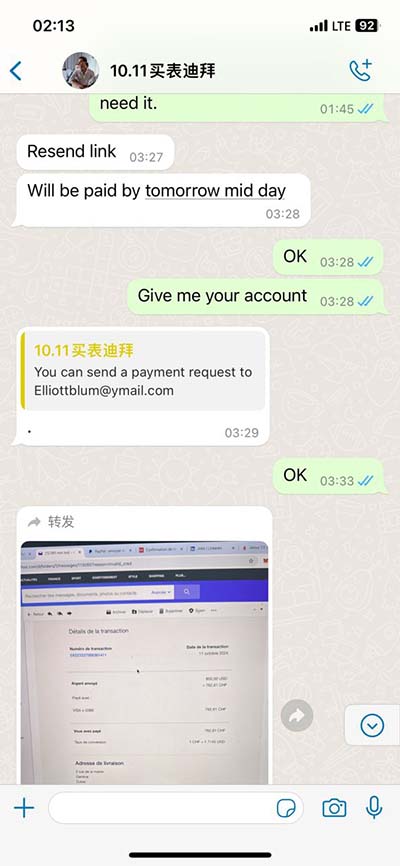

The bigger bill is actually CA sales tax at 9% which gets generated automatically when custom is paid. The systems are linked. BTW, purses from France has a very high tax rate due to tariff set by our last President which is still in effect, so be aware. The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one is 9101. I recently found out that when you purchase a Rolex out of state to save on sales tax, it may come back to haunt you. The reason being is that just because the AD is not required to charge you tax, does not mean that you do not have to declare it. The merchant sold you a watch for X amount of money, say 5K, he reports the sale anmount of 5K to the state tax commission which then requires him to collect sales tax on that amount. Your trade-in has no bearing on the price of the watch other than lowering the amount you have to pay for it.

The U.S. has a tax exemption of 0 per person on items bought abroad. Family members can combine their 0 tax exemptions in a joint declaration of value. Items valued ,000 over the exemption are taxed at three percent. Beyond .

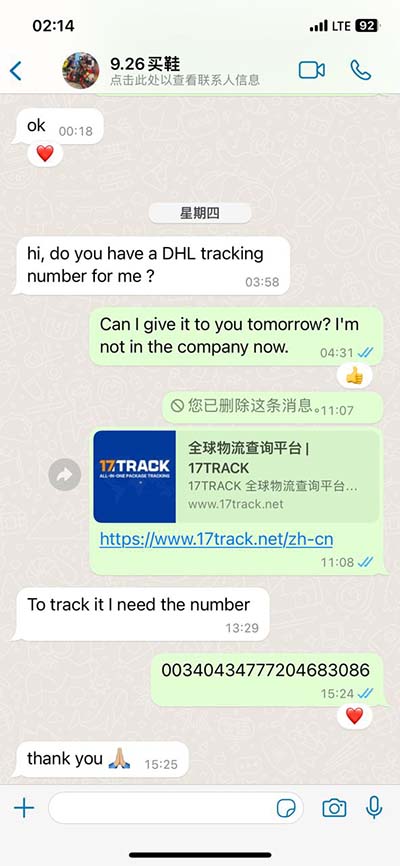

It should be similar for you if you exchange vat with your states sales tax. As for just wearing it on your wrist without declaring it: i am pretty sure thats a felony if you get caught. If you can afford a 10k watch you can afford to pay the taxes. If one is looking at buying off C24 from a US dealer, it's silly to go through C24. Just look who the dealer is and go directly to them. You'll avoid any silly buys premium and in many cases you'll avoid sales tax. With this in mind, one of the most common questions potential buyers ask is: where can you buy a Rolex in the USA and legally avoid the payment of sales tax? The best way to achieve this is to purchase a Rolex online, although it is important to understand precisely how this works and what the limitations are.

You should carefully check the tax laws concerning “use tax” if your state imposes a sales tax. If you purchase an item in a state with lower (or no) sales tax, you owe the amount of tax difference. If you owed the sales tax, it's not legal to avoid paying it. It may be no one charged you sales tax, but that does not mean you don't owe it. The bigger bill is actually CA sales tax at 9% which gets generated automatically when custom is paid. The systems are linked. BTW, purses from France has a very high tax rate due to tariff set by our last President which is still in effect, so be aware.

dior annual report english

The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one is 9101.

I recently found out that when you purchase a Rolex out of state to save on sales tax, it may come back to haunt you. The reason being is that just because the AD is not required to charge you tax, does not mean that you do not have to declare it.

The merchant sold you a watch for X amount of money, say 5K, he reports the sale anmount of 5K to the state tax commission which then requires him to collect sales tax on that amount. Your trade-in has no bearing on the price of the watch other than lowering the amount you have to pay for it.

The U.S. has a tax exemption of 0 per person on items bought abroad. Family members can combine their 0 tax exemptions in a joint declaration of value. Items valued ,000 over the exemption are taxed at three percent. Beyond . It should be similar for you if you exchange vat with your states sales tax. As for just wearing it on your wrist without declaring it: i am pretty sure thats a felony if you get caught. If you can afford a 10k watch you can afford to pay the taxes.

does Rolex pay taxes

Estimasi Harga Dompet Louis Vuitton Pria Termahal di Indonesia. Rp64.525.000. Yuk tampil dengan gaya fashion terupdate dengan menggunakan Dompet Louis Vuitton Pria terbaru yang bisa kamu beli di Tokopedia.

how to avoid sales tax on a rolex|does Rolex pay taxes