lv funds | lv investment log in lv funds The LV= TIP is a plan which invests in our Smoothed Managed Funds. It allows you access to our unique funds as part of your investment strategy in Self-invested Personal Pensions (SIPP) or Small Self-administered Schemes (SSAS).

Our expert team of authenticators has another guide for you: Louis Vuitton Bumbag. Commonly known as the Louis Vuitton Fanny Pack. Let’s see how to tell if your Louis Vuitton bag is real or fake. How to spot a fake Louis Vuitton Bumbag. The best method to spot a fake Louis Vuitton Bumbag is to examine the engraving on the strap.

0 · lv with profits pension

1 · lv with profits latest news

2 · lv with profits fund performance

3 · lv with profits fund

4 · lv smooth managed funds

5 · lv investment log in

6 · lv fund factsheets

7 · liverpool victoria with profits fund

Deck recipe and video showing the order of the cards comment for suggestions and improvements

See the latest fund prices for your investments. Find out the unit and share prices for LV= fund and investment options. Click here to track your investment by checking out our latest prices today.

View daily fund pricing and historical performance of the LV= Core Fund range. Access free .

lv with profits pension

lv with profits latest news

See the latest fund prices for your investments. Find out the unit and share prices for LV= fund and investment options. Click here to track your investment by checking out our latest prices today.View daily fund pricing and historical performance of the LV= Core Fund range. Access free Fund X-Ray reports and Fund Fact Sheets. Rank and compare all funds in the LV= fund. Search and segment by Active/passive and asset class.You can choose from a range of independently risk-rated investment funds to meet your attitude to risk. The funds are managed by our award-winning in-house team and leading investment managers. Our smoothed funds have low impact charges, meaning your investment won’t be eaten into by high fees.The LV= TIP is a plan which invests in our Smoothed Managed Funds. It allows you access to our unique funds as part of your investment strategy in Self-invested Personal Pensions (SIPP) or Small Self-administered Schemes (SSAS).

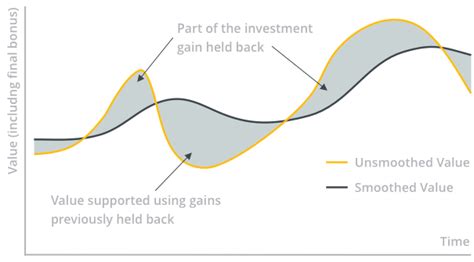

The LV= Smoothed Managed Funds provide an investment journey with a smoother return profile than is generally available from many multi-asset investment funds through our fund price averaging mechanism.LV= Core funds. Our Core funds offer a straightforward and low cost option. Your client must invest in our Core funds to take our Personal Pension – they can then add further options to suit their needs. Minimum investment of £30,000. 200+ . We screened for the open-ended funds and exchange-traded funds that ranked in the top 25% of the category using their lowest-cost share classes over the past one-, three-, and five-year periods.Looking for fund information? If you are an existing investment customer we can help you with: Flexible Guarantee Bond, Heritage Policies, RNPFN, Tracing a pre-1998 policy and much more. Explore how we can help you here.

The latest fund information for LV= Smoothed Managed Growth Pn, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.LV=’s Smoothed Managed Funds are expertly managed and responsibly invested. Learn more about what fund management and responsible investing means to us. For UK Financial advisers only.See the latest fund prices for your investments. Find out the unit and share prices for LV= fund and investment options. Click here to track your investment by checking out our latest prices today.

View daily fund pricing and historical performance of the LV= Core Fund range. Access free Fund X-Ray reports and Fund Fact Sheets. Rank and compare all funds in the LV= fund. Search and segment by Active/passive and asset class.You can choose from a range of independently risk-rated investment funds to meet your attitude to risk. The funds are managed by our award-winning in-house team and leading investment managers. Our smoothed funds have low impact charges, meaning your investment won’t be eaten into by high fees.The LV= TIP is a plan which invests in our Smoothed Managed Funds. It allows you access to our unique funds as part of your investment strategy in Self-invested Personal Pensions (SIPP) or Small Self-administered Schemes (SSAS).

The LV= Smoothed Managed Funds provide an investment journey with a smoother return profile than is generally available from many multi-asset investment funds through our fund price averaging mechanism.LV= Core funds. Our Core funds offer a straightforward and low cost option. Your client must invest in our Core funds to take our Personal Pension – they can then add further options to suit their needs. Minimum investment of £30,000. 200+ . We screened for the open-ended funds and exchange-traded funds that ranked in the top 25% of the category using their lowest-cost share classes over the past one-, three-, and five-year periods.Looking for fund information? If you are an existing investment customer we can help you with: Flexible Guarantee Bond, Heritage Policies, RNPFN, Tracing a pre-1998 policy and much more. Explore how we can help you here.

lv with profits fund performance

The latest fund information for LV= Smoothed Managed Growth Pn, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.

lv with profits fund

lv smooth managed funds

lv investment log in

lv fund factsheets

Kalnu slēpes, distanču slēpes, snovborda dēļi, zābaki, nūjas, apģērbi, apavi, somas, brilles, ķiveres, velosipēdi, velorezerves daļas, aksesuāri, supi .

lv funds|lv investment log in